Help with the Cost of Living

|

|

|

Managing your money is crucial right now because things are more expensive in the UK.

According to ‘Statista’ 92% of UK households reported that their cost of living had increased compared with a year earlier and many people have reached crisis point.

We are keen to help care leavers learn how to budget for different things like home expenses, buying food and clothes, socialising, and Christmas.

According to ‘Statista’ 92% of UK households reported that their cost of living had increased compared with a year earlier and many people have reached crisis point.

We are keen to help care leavers learn how to budget for different things like home expenses, buying food and clothes, socialising, and Christmas.

Top Tips for Budgeting

|

If you have a broken item that you can't afford to replace, try taking it to your local Repair Café. A volunteer will try and repair it for free, they just ask for a small donation! You can find a local repair cafe by visiting your council’s website or you can search for one here: https://www.repaircafe.org/en/visit/

|

Household & BillsFind out more

|

Household Bills and Energy SavingFind out more

|

Saving & BankingFind out more

|

WaterFind out more

|

Food ShoppingFind out more

|

Socialising

Find out more

|

ClothingFind out more

|

ChristmasFind out more

|

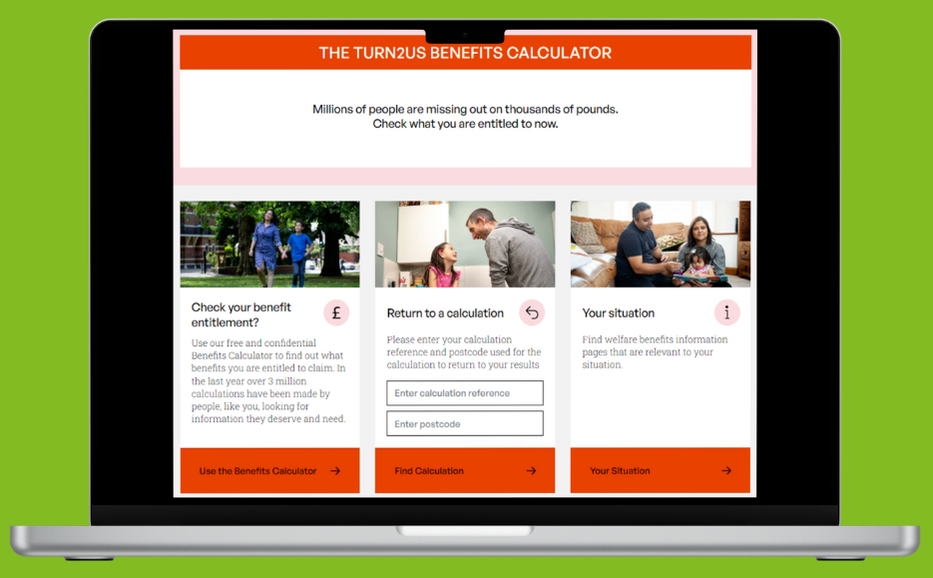

Turn2Us Benefit CalculatorUse the free Benefits Calculator to find out what benefits you can claim.

|

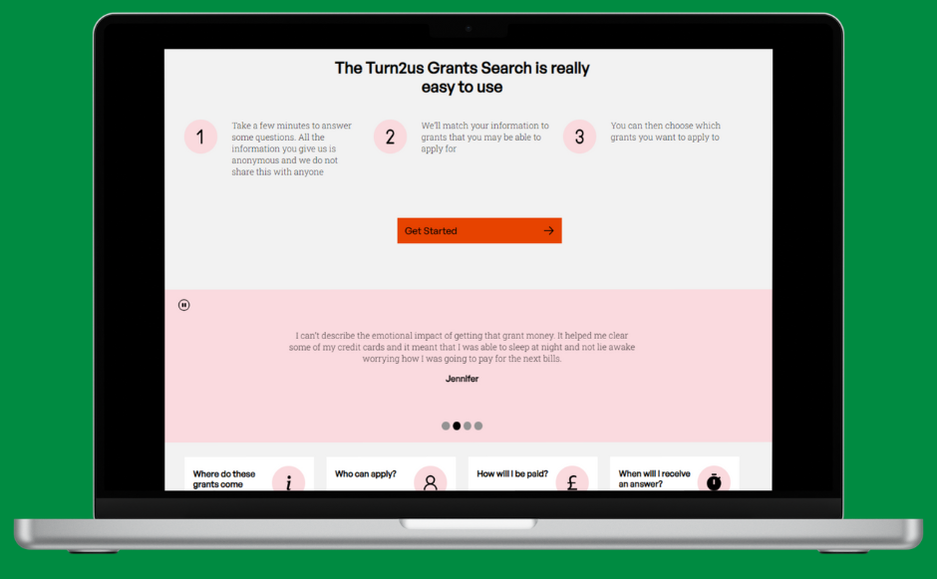

Turn2Us Grant SearchTake 10 minutes to find out if you could get help from charitable grants.

|

For more information about how we can help care leavers into employment, please visit the pages below;

�

|

|

Our team are available Mon-Fri from 9-5 excl. UK Bank Holidays or click here for other ways to get in touch |

|

The Rees Foundation, Craftsman House, De Salis Drive, Hampton Lovett, Droitwich, Worcestershire, WR9 0QE

Telephone 0330 094 5645 Email [email protected]

Telephone 0330 094 5645 Email [email protected]

Registered Charity Number: 1154019 Registered with ICO: ZA027769